Investors

From Term Sheet to Closing

Whether you have just one company on Fidelity Private Shares or want to manage your whole portfolio, we make the process seamless. Equity financings can be closed faster, typically at lower cost, and you’ll have access to the data and documents you need. Fidelity Private Shares connects everything from term sheet monitoring to make it all easier for you.

.png?width=2000&height=1125&name=Investments%20Holdings%20(COMBINED).png)

Your Private Company Holdings

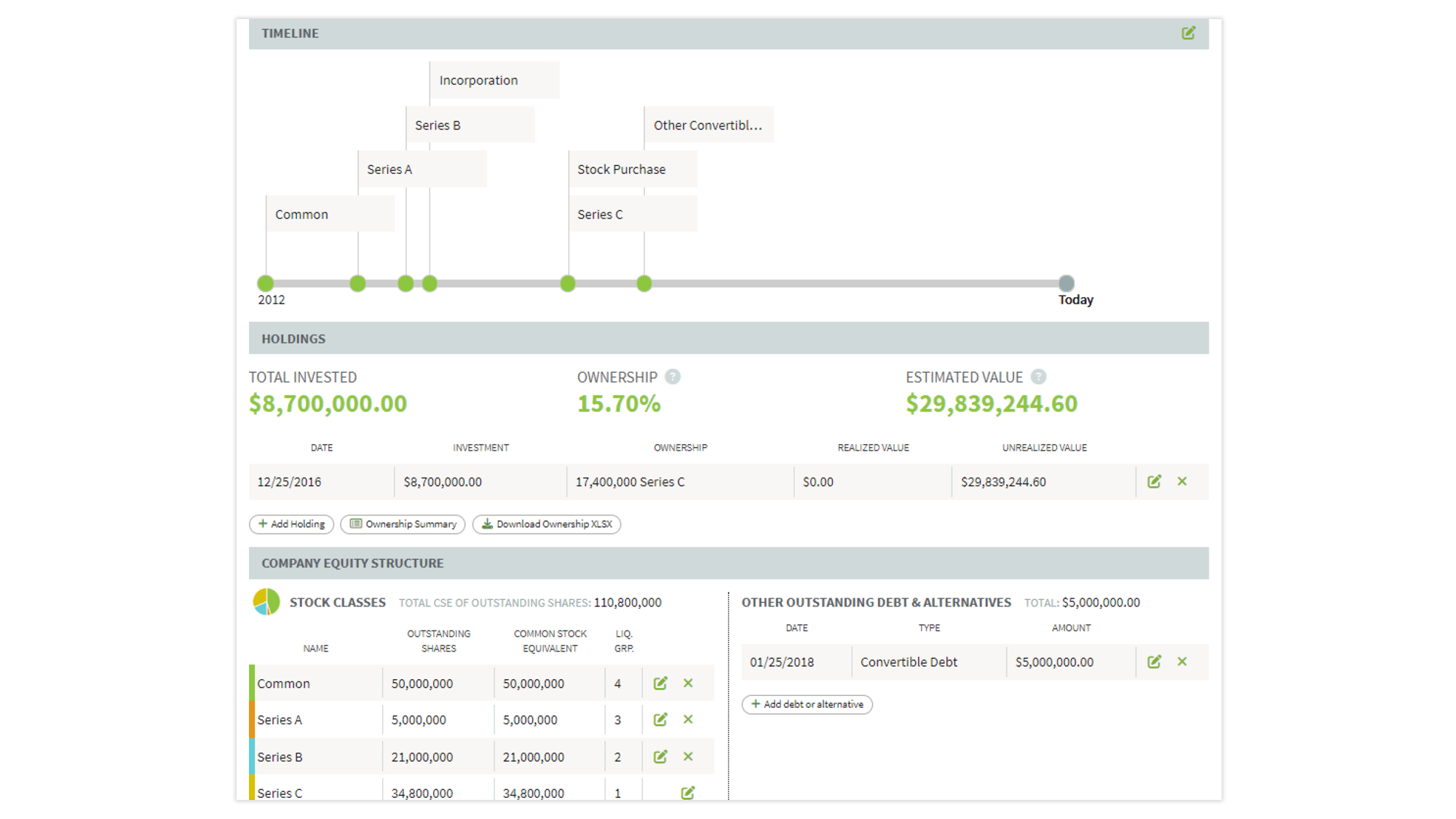

You can get the information you may need about your private investments, with a single, easy-to-use dashboard. This data can be shared with a fund administrator or an auditor, and can even be used as the basis for a full audit. If there’s pertinent information about your portfolio, it’s on Fidelity Private Shares. Even if those companies aren’t yet on the platform, you can interact with company data, including:

- Portfolio view with holdings details

- Ownership summary and total investment

- Storage for all important documents

Analytics and Exit Scenario Modeling

The platform doesn’t just give you access to in-depth information about your current holdings; we give you the tools you need to plan ahead. Our analytics capabilities include:

- Modeling and tracking multiple exit scenarios

- Visualizing additional investment and outcomes

- Internal Rate of Return and Cash-on-cash calculations

Fund Performance Tracking

Use Fidelity Private Shares to capture information about your funds to see key metrics, like disbursements to paid-in-capital, total value to paid-in-capital, and internal rate of return for each fund.

Individual Company Records

Click on a company in your portfolio to get detailed information, including valuation history and financials, company timeline, links to documents, and any notes you’ve added. If the company is also on the platform, the data can be automatically updated. Company profiles can be exported as PDFs to make reporting easier.

Why should your portfolio companies join Fidelity Private Shares?

For portfolio companies that are on Fidelity Private Shares, you will automatically get updates on your holdings and equity structure. Your companies will gain access to a legal operating system that handles their HR, equity, fundraising, and governance needs, from incorporation to exit. Plus, being on the platform makes the next round of fundraising easier for both sides: key documents are immediately accessible, transactions are automatically tracked, and all stakeholders have access to a cap table that updates in real time.

During a financing, save yourself time by having the Fidelity Private Shares automatically draft standard NVCA or series seed financing documents based on your term sheet. Leveraging software to run an equity financing means you can typically reduce the risk of errors, sign documents electronically, and get insight into your deal status. After closing, there’s no waiting for your documents and stock certificates—and no need to manually re-enter the data from the financing and information rights requests if you also use the platform for portfolio management.

1124389.1.0