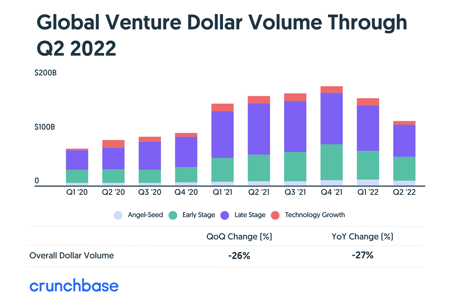

It’s no secret that it’s a tricky time for companies raising capital. After a record-breaking year in 2021 where venture funding almost doubled to $669 billion, the venture capital market has slowed down in 2022. This means that companies should look for alternative options when it comes to raising capital.

Source: Crunchbase

Founders should learn about one of these alternatives to equity financing: non-dilutive financing. Non-dilutive financing provides capital that doesn’t require an owner to give up any equity or ownership of their company.

What are different types of non-dilutive financing?

There are many different types of non-dilutive financing, and the one that is right for your company depends on many factors, such as current and predicted revenue.

Some different types include:

- Revenue-based financing, which provides upfront cash in exchange for a percentage of ongoing revenue

- Asset-based financing, which is a loan secured by inventory, accounts receivable, equipment, or other property owned by the borrower

- Venture debt has many types, with term loans being the most common

What are the best resources for non-dilutive financing?

At Fidelity, we work with companies at all stages and are able to save them time by connecting them with the best resources for their needs. The following are nine companies that provide non-dilutive financing. See if any of them are right for your current needs.

Dwight funding

Type: Asset-based

They work with: Disruptive DTC, Food & Beverage, Beauty, and General CPG brands with annual revenue of $3mm to $100mm and a minimum of $500k in A/R or $1mm in inventory. Dwight focuses on value-add partnership, and portfolio companies benefit from their experience, network and reputation in the industry.

Capchase

Type: Revenue-based

They work with: Software as a Service, non-SaaS Subscription-based, & contracted revenue companies with an ARR of $250k-100M+, 6+ months of revenue history, and at least 3 months of runway.

Ampla

Type: Revenue-based

They work with: Emerging consumer brands based in the United States, $500k - $5M monthly revenue with omnichannel sales (Shopify, Amazon, retail / wholesale). Specialty in food and beverage, beauty and wellness, apparel and accessories, home and pet, and sporting goods.

RevUp

Type: straight revenue contract and repurchase-able equity

They work with: early stage companies with $500K-$3M in revenue.

Pipe

Type: Revenue-based

They work with: SaaS, D2C, Service, Media & entertainment, Insurance, other companies.

CircleUp

Type: Asset-Based and cash-flow based

They work with: U.S.-based consumer brands, as well as their service providers, specialty retailers, and online retailers, ideally $100k revenue per year with a 1+ year operating history.

ClearCo

Type: Revenue-based

They work with: e-commerce, mobile apps, and SaaS companies.

LighterCapital

Type: Revenue-based

They work with: technology startups and companies in the US, Canada, and Australia with monthly recurring revenue (MRR) averaging at least $15K in need of up to $4M in non-dilutive funding.

Espresso Capital

Type: Revenue-based

They work with: High-growth technology companies in the United States, Canada, and the UK with at least $5 million in revenue that provide mission-critical core operations and other high-value solutions to customers.

Want to get more expert guidance on all things financing and startup related?

Sign up for our newsletter to get resources sent directly to you.

Our automated platform helps founders with all startup equity management operations, providing guidance and securing data in a single data room with customized access; ultimately, enabling financing in 14 days or less. Learn more about how we can help your company.