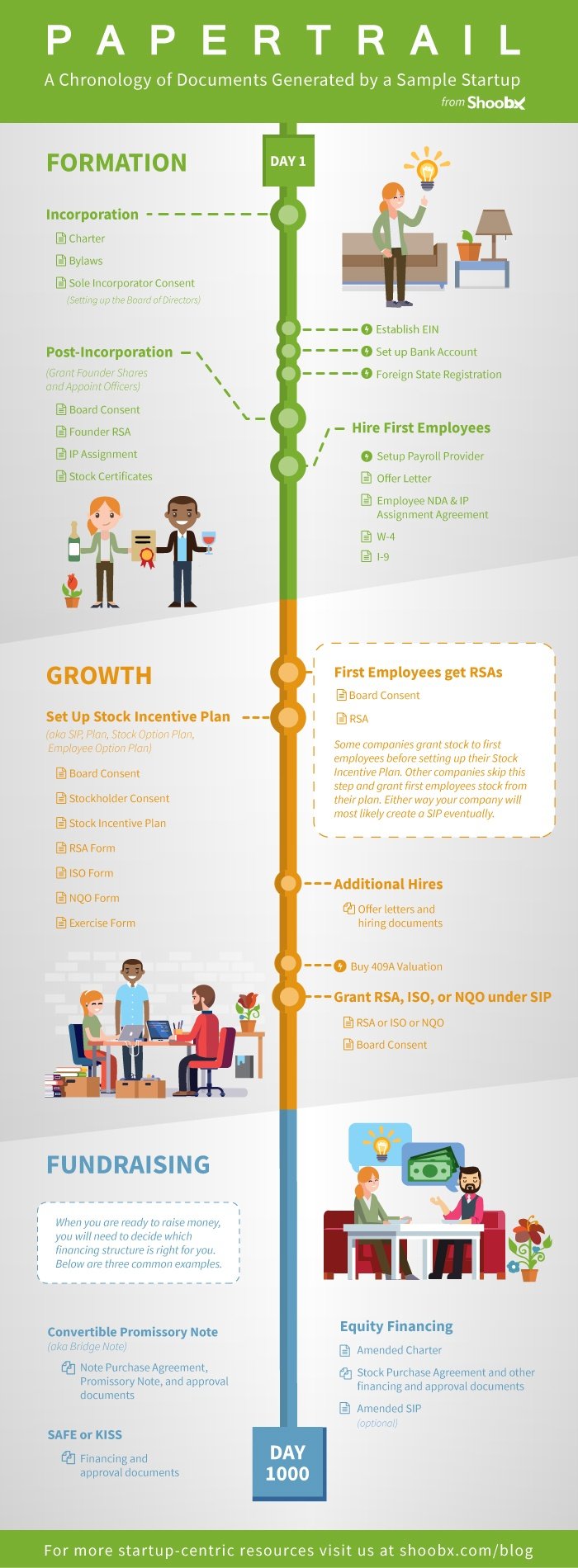

A lot of startup founders know they have to grant founder shares and raise money, but they’re not sure in what order and with which documents they should do these things. When they ask “Should I set up a stock incentive plan before or after I grant my first employee shares?” or “Do I need to set up a bank account now or later?” they often get vague answers like, “it depends on your company’s unique circumstances.”

It’s frustrating to hear that, but it’s true. So, while I cannot tell you what your company should do, this timeline is the pattern we see a lot of companies follow. Only your lawyer can tell you for certain if this is the right timeline for your company.

Disclaimer: This is a general overview, and not definitive by any means. The path each company takes can vary. Shoobx is super awesome and does a lot of these things. To learn more about the parts we can do for you, visit the Shoobx website.

Author: Kathy Nolan, Client Services Manager and Corporate Attorney for Shoobx, Inc.

Illustrator: Jason Grover, Designer for Shoobx, Inc.

The Shoobx data room helps you organize all of your documents.