When forming a new company, founders are immediately faced with the question of how many shares the company should initially authorize (i.e. the maximum number of Common shares the company may initially issue). This information goes right in the company’s Charter, so there’s no avoiding it. When you pick that number, it’s helpful to have a sense about where those shares will eventually go.

Where to Start?

For many high-tech startup companies that intend to hire employees and raise capital, the sweet spot is around 10 million shares. It’s a nice round number that gives you plenty of room to work with.

Why not less? If you choose too few shares, you may soon have to amend your company’s Certificate of Incorporation (a.k.a. Charter) to increase authorized shares to cover new issuances for events like adopting an option plan or issuing equity to an investor.

Why not more? If 10 million is good, is 100 million better? Why not a billion? The answer is franchise taxes. If you authorize too many shares, then you may be subject to additional franchise tax on shares you’re not using or planning to use. The Secretary of State of Delaware provides a franchise tax calculator you can use to estimate your tax liability.

It’s worth pointing out that authorizing shares doesn’t mean you have to grant them—now or ever. Authorizing shares just makes it possible to issue them, and that can be done on any timeline.

At some point in the trajectory of your growing company, you will likely amend or restate your Charter—like when you accept a nice big juicy round of institutional funding. Until then, it’s quite possible to avoid the hassle and expense of premature amendment filing by anticipating the needs of your likely recipients and leaving yourself enough wiggle room.

An Example

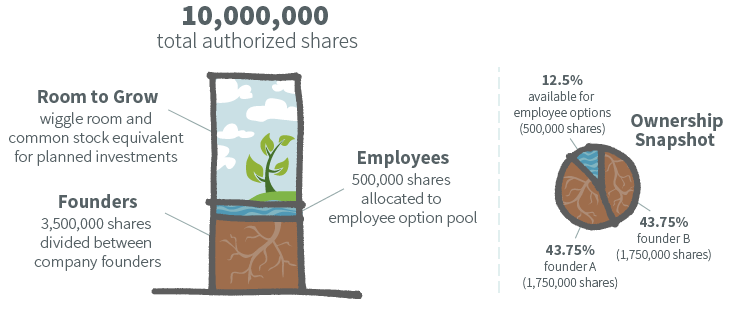

Let’s look at how one sample high-tech startup company that intends to hire employees and raise capital plans to use their 10 million authorized shares.

The first allocation they will decide is the number of shares that go to the founders. If they divide all of the authorized shares between the founders, they’ll obviously have to authorize more as soon as they take on employees or investors. But they need to grant themselves enough shares so that they have flexibility when it comes time to raise seed financing and hire the first employees.

Remember, ownership percentage is relative to the shares that have been granted, not the total number of shares that have been authorized. This sample company chooses to authorize 10 million shares and divide 3.5 million of those shares between their two founders. Each founder will own fully 50% of the company (until any other grants are made). The fact that each founder owns only 17.5% of the authorized shares isn’t salient. In fact, I feel silly even mentioning this percentage given its irrelevance!

If the founders had decided to grant only 50 shares to each founder they would still each have a 50% stake in the company (exactly the same ownership percentage as the scenario above, where each founder was granted 1.75 million shares), but they’d run into difficulty as soon as they wanted to grant shares to anyone else. In that case, giving someone just one share would be giving that person almost 1% ownership of the company. Since shares are granted in whole number increments and most grantees receive small percentages of ownership, founders need to have enough shares in play to allow them to be precise when making stock awards.

Having millions of issued shares also allows founders to be sensitive to how people perceive the size of their option grants. A company will need employees, consultants, and advisors, and it will likely want to attract the best. Workers in the high-tech sector often assume that equity will be part of their compensation package. It’s important that the option awards offered to new hires seem competitive. Imagine a potential employee weighing an offer that includes a grant of 25,000 options versus a comparable offer from another company with the same salary but only 1,000 options. If the first company has issued 3.5 million shares in total and the second company has only issued 100,000, the second company is actually offering a higher percentage of ownership, but it may still suffer in the comparison and lose out on the candidate. While employees should appreciate the distinction in this example, they rarely do.

Knowing they’ll need to be savvy about perception and percentages (and are all-too-happy to avoid long conversations about what equity is worth), our sample company, that had allocated 3.5 million shares to its founders, decides to authorize 500,000 shares for its employee stock option pool, bringing the total number of allocated shares to 4 million. When they take on investors, they may re-evaluate the size of the employee option pool. Investors understand the importance of attracting top talent so they may (and usually do) insist on an increase to the employee pool as part of their investment.

After issuing stock to founders and setting up their Stock Incentive Plan, here’s what the company’s use of authorized shares will look like along with a snapshot of the current ownership percentages:

The company plans to grow fast so they are bound to need some seed funding. As you can see, they have ample buffer, 6 million shares, to cover any funding obligations or to handle the unexpected.

With 10 million authorized shares, this company is nicely positioned to get all the way to their Series A round before needing to amend their Charter and increase the number of authorized shares.

Your Company, Your Number

10 million might be the right number for a technology startup company with plans to hire employees and raise funds. Like Goldilocks, you’ll want to find the number that’s just right for you. Your lawyer or other business advisors can address your specific needs and help you along the way.

That Other Question

If you’re pondering the right number of authorized shares for your new company, you probably also need to think about what your stock’s Par Value should be. Check out our blog post about setting your Par Value.

Want to keep your cap table organized and automatically updated? Talk to Fidelity today.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation. Third party mentioned and Fidelity are not affiliated.

1096782.1.0